5 Mistakes Legal Teams Make When Rolling Out a DMS.

Welcome to Legal Ops Briefs—inspired by the mot-r mindset, this blog series of 3-minute reads gives in-house Legal Ops quick, operational insights....

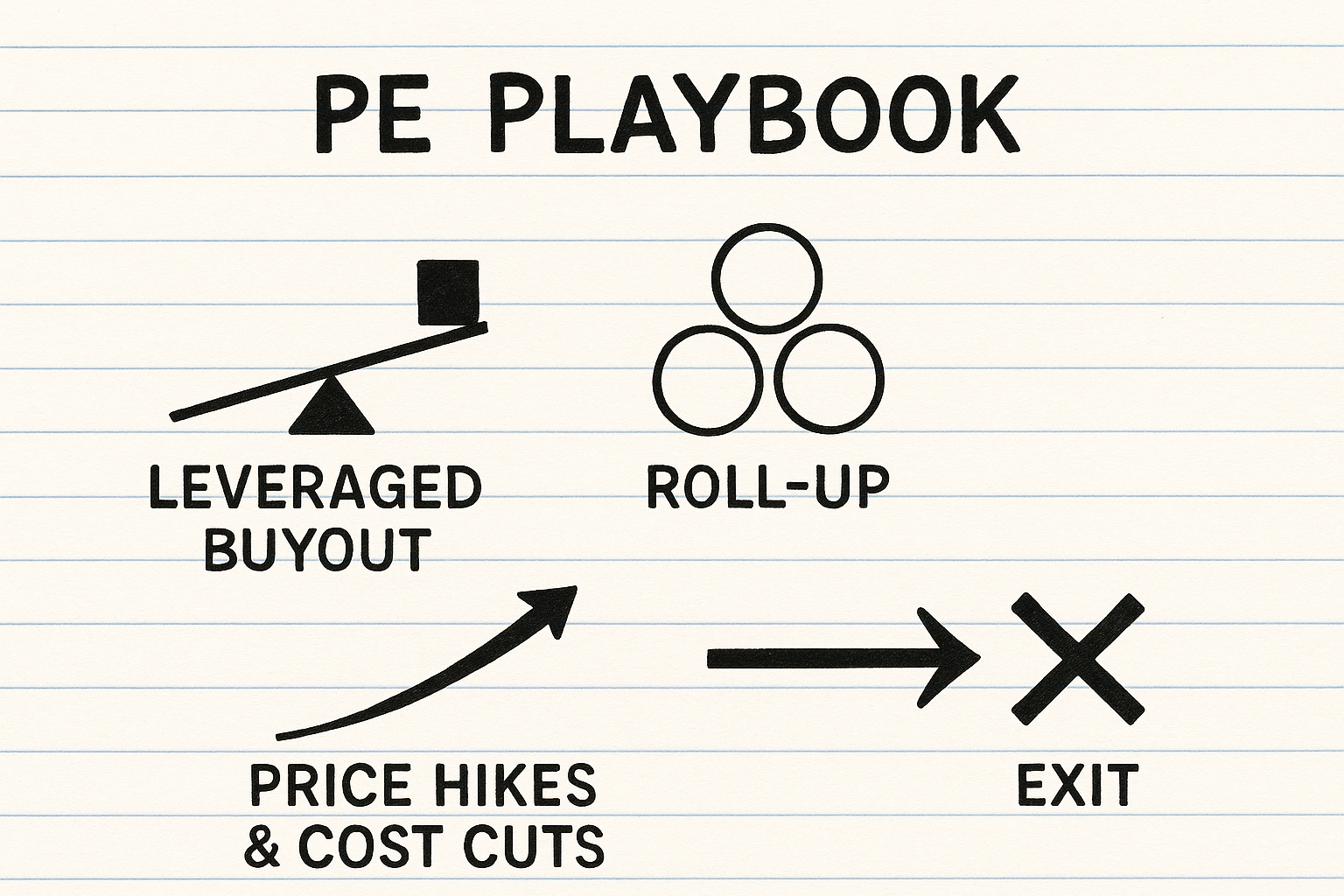

What PE firms typically do once they buy into a legal tech software vendor, why they do it, and where customers can get burned.

|

Playbook Step |

What PE Sponsors Actually Do |

Legal-Tech Examples |

Customer-Side Risks & Harms |

|

1. Buy with Leverage |

Use 50-70 % debt to fund the deal and load that debt on the target’s balance sheet. |

• Warburg Pincus & Cove Hill recap NetDocuments in 2021 (undisclosed purchase price). • Hg takes Litera private in 2019, funds 10+ bolt-ons with unitranche debt. |

High fixed debt service → pressure to cut costs (support, R&D) and raise prices. |

|

2. Roll-up Bolt-ons |

Acquire direct competitors or adjacent workflow tools, then collapse them into one platform to grow ARR fast. |

• NetDocuments → Worldox (Oct 2022) adds 6,000 SMB firms in one shot. LawSites • Onit (K1, $200 M) buys SimpleLegal (2019), BusyLamp (2021), Bodhala (2022). Onit |

• Forced migrations (Worldox desktop → NetDocs cloud). LexWorkplace reports higher TCO and data-conversion fees. LexWorkplace |

|

3. Raise List Prices & Retire “Overlaps” |

After integrations, sunset duplicate SKUs, impose subscription-only licensing, and embed annual uplift clauses (+7–12 %). |

• Litera ends support for Workshare Compare & DocsCorp suites, pushing firms to new Litera bundles. Innovative Computing Systems, Inc.Legal IT Insider |

• Price hikes during renewal; customers pay to re-train staff or re-platform. |

|

4. Cut SG&A to expand EBITDA |

Trim overlapping marketing & support teams to hit the 20–30 % EBITDA margin PE funds expect. |

• Litera cut AUS marketing & product staff after DocsCorp acquisition. Legal IT Insider |

• Reduced regional support windows; slower bug-fix cycles. |

|

5. Cross-sell & Bundle |

Use the new, larger install base to upsell add-ons (e-billing, contract AI) and squeeze more ARR per customer. |

• Onit bundles Bodhala spend analytics with SimpleLegal mid-market ELM. • NetDocuments sells ndThread & CollabSpaces to Worldox converts. |

• Increased vendor lock-in; switching costs escalate as more workflows sit in one stack. |

|

6. Refinance or Exit in 3–7 yrs |

Sell to another PE firm, list via IPO, or flip to a strategic—pocket the multiple expansion. |

• Silver Lake buys into Relativity at a $3.6 B valuation (2021) and will seek a 2–3× return at exit. Built In Chicago |

• Another owner can restart the cycle—new debt, new price schema, new road-map priorities. |

|

Clause / Action |

What it Protects Against |

|

Price-cap clause: max CPI+2 % |

Shields against post-buyout hikes. |

|

Change-of-control opt-out |

Right to terminate or demand free migration if ownership changes. |

|

Road-map escrow / source-code escrow |

Coverage if acquirer sunsets or pivots the product. |

|

Support-staff SLA (FTE ratio) |

Prevents aggressive head-count cuts from crippling service. |

|

Data-export in open standard (JSON, XML) |

Lowers switching cost if PE roll-up forces an unwanted bundle. |

Key take-away

Investor-owned platforms can deliver real scale and innovation—but the PE playbook (debt, roll-ups, price lifts, support cuts) creates predictable customer pain points. Write strong contract clauses (price caps, change-of-control escape, support SLAs, open-data export) and keep an eye on ownership news so you’re protected before a deal closes.

Add one more lever—look beyond the funded crowd.

Bootstrapped or family-owned vendors such as LEAP (small-firm PMS), Dennemeyer (global IP management), mot-r (legal work orchestration) and long-standing niche tools like Tabs3 often:

Including at least one “un-funded” alternative in every RFP keeps pressure on PE-backed suppliers—and gives you a fallback if the next roll-up cycle makes your current vendor too expensive or too risky.

Welcome to Legal Ops Briefs—inspired by the mot-r mindset, this blog series of 3-minute reads gives in-house Legal Ops quick, operational insights....

Welcome to Legal Ops Briefs—inspired by the mot-r mindset, this blog series of 3-minute reads gives in-house Legal Ops quick, operational insights....

Welcome to Legal Ops Briefs—inspired by the mot-r mindset, this blog series of 3-minute reads gives in-house Legal Ops quick, operational insights....